-

What is an Investment Agreement?

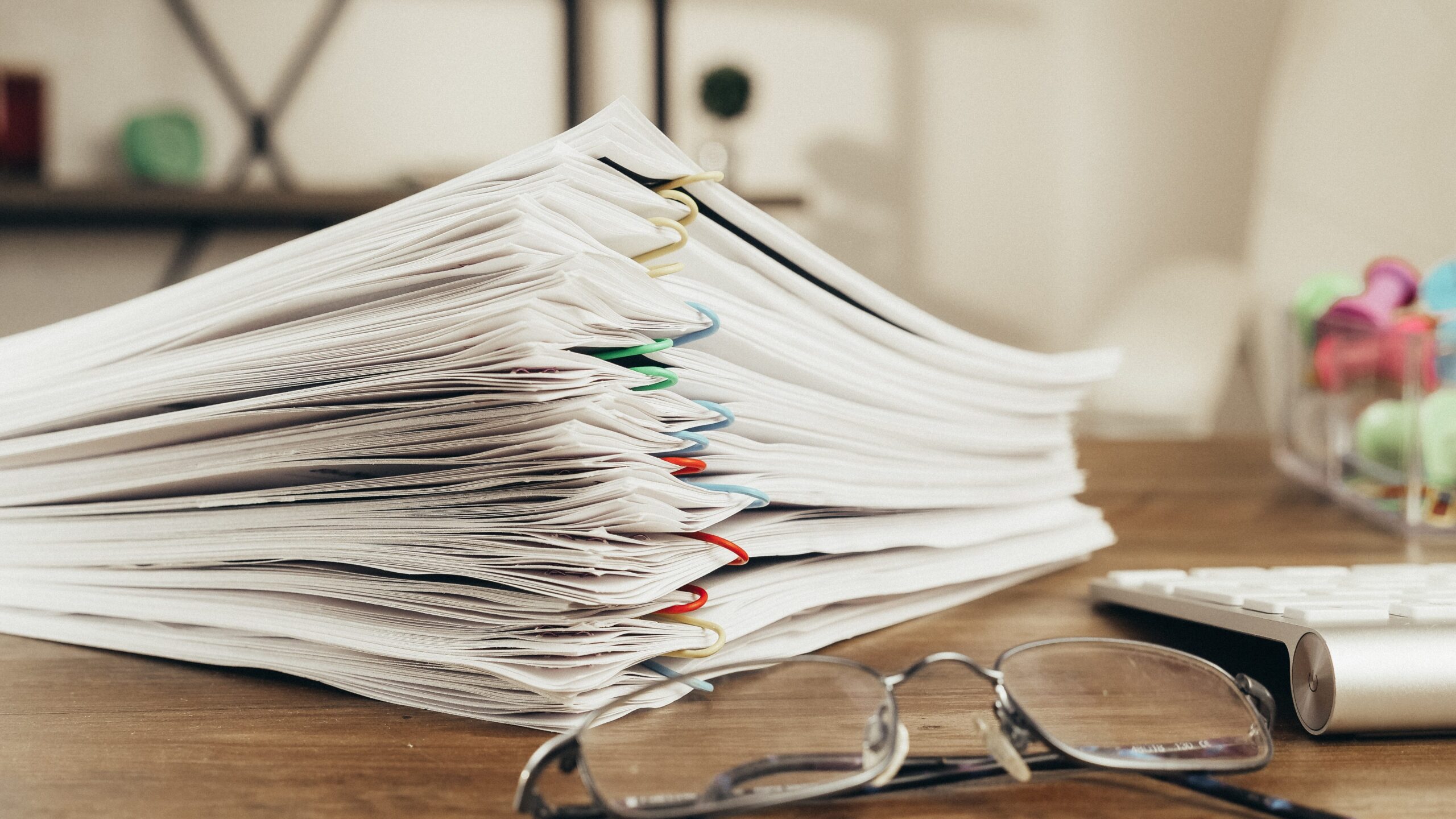

In the final part of our investment documents blog series, we will dive into the investment agreement. Whereas the term sheet is the starting point, the investment agreement is sort of the final step. The investment agreement is the document that sets out the investment details. It includes the actions required to close the investment and the structure of the investment itself. Besides, the investment agreement typically consists of the representations and warranties of the company and the existing shareholders. Once the investment agreement has been approved, everything is set for the investment. Investment Requirements for the Investment The investor

-

Trind Invests in Wudpecker, a Finnish Startup Tackling Organizational Knowledge Fragmentation

Trind led the €330 000 pre-seed investment round of Wudpecker, a groundbreaking AI-driven knowledge management startup. Accelerace and Sofokus Ventures joined us in the round. Resolving the Information Scourge in the Digital Workspace Wudpecker has boldly entered the arena with an AI tool designed to empower professionals to seamlessly extract critical answers from a plethora of data – notes, files, emails, and online meetings, using simple, intuitive prompts. The problem of information fragmentation and knowledge loss is a poignant issue in the digital era. A study by IDC illustrated that employees burn approximately 2.5 hours per day scavenging for information.

-

Trind invests in Your.Rentals

Your.Rentals announces the successful closing of an investment from Trind Ventures. Combined with the successful Seedrs raise, Your.Rentals has secured €2.7 million in growth finance this year. Your.Rentals is a trusted platform for short-term rental owners and property managers worldwide. Your.Rentals simplifies the process of managing short-term rentals, providing owners and property managers with increased visibility, control, and revenue. With a global presence and a dedicated team, Your.Rentals is redefining the short-term rental industry. We are extremely excited to partner with Trind Ventures. Their expertise and track record in scaling disruptive technology companies make them the perfect partner to help us take our business to the next level.

-

Boksi Successfully Concludes 7M Series A Funding Round

Leading influencer marketing and content creation platform, Boksi.com, is pleased to announce the successful completion of its €7 million Series A funding round. The round was conducted in two closings, with the first closing taking place in late 2022 and the final closing recently. The funding round was led by pan-European technology investor 3TS Capital Partners in collaboration with Nexit Ventures. Existing investors, including Trind Ventures, Aikainen Ventures, Business Finland and several respected angel investors, demonstrated continued confidence in Boksi’s growth trajectory by participating in the round. Investors were drawn to Boksi’s innovative solutions that have been reshaping the influencer

-

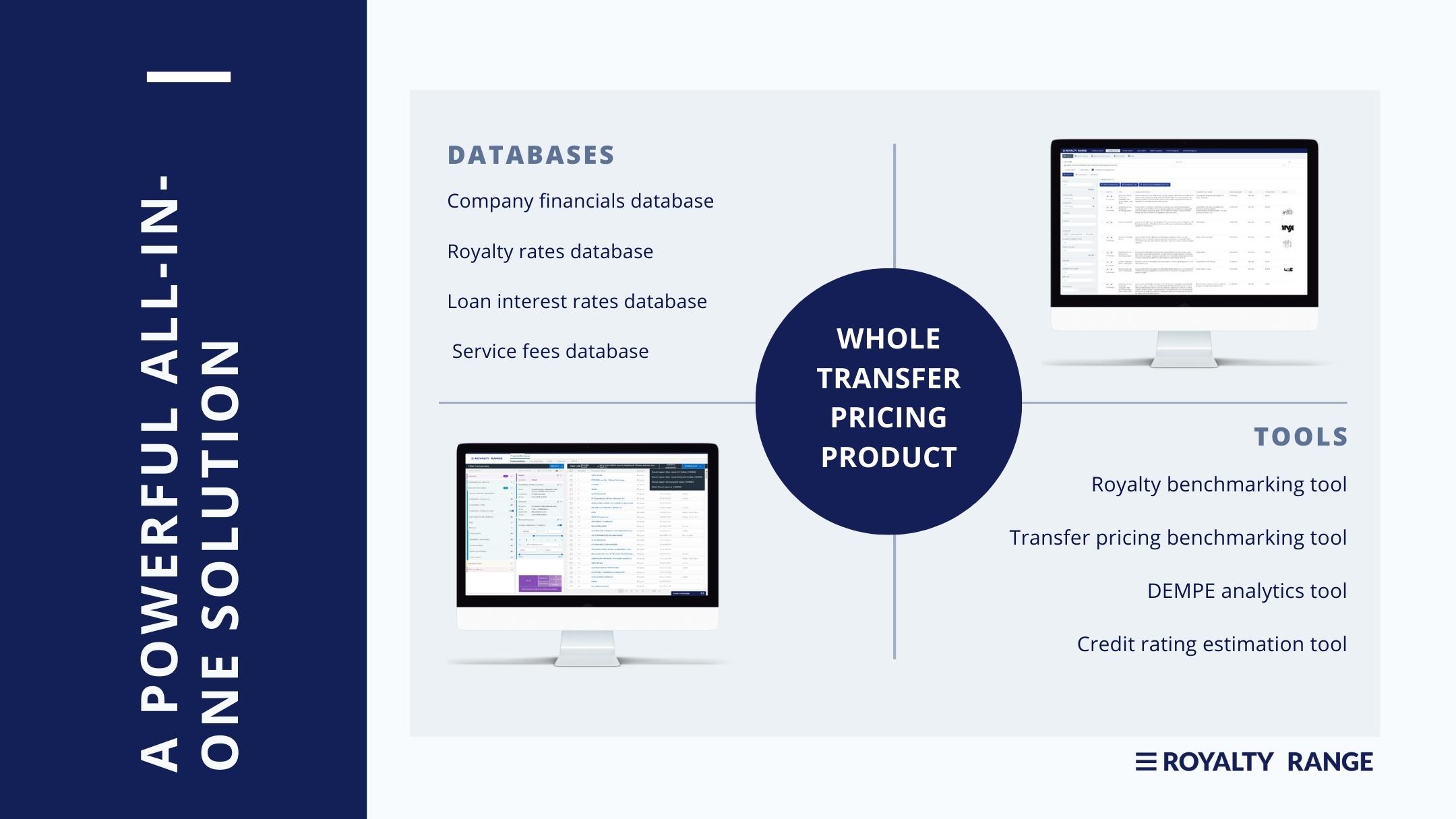

In Spotlight: RoyaltyRange

In this blog, we put the spotlight on RoyaltyRange, a leading provider of transfer pricing and IP valuation solutions. About RoyaltyRange RoyaltyRange is a leading provider of transfer pricing and IP valuation solutions. The company offers a comprehensive database of royalty rates, company financials, and other relevant data, as well as a variety of tools and resources to help businesses analyze their data and develop sound transfer pricing and IP valuation strategies. RoyaltyRange is well-positioned for continued growth in the years to come and is a valuable resource for businesses of all sizes. RoyaltyRange was founded in 2017 by a

-

Trind invests in services marketplace Webel

Webel, the app that brings any service to your doorstep, raises €2.1M led by Trind Ventures. Everything is being brought to our homes: food, consumer goods… even flowers. However, services (e.g., beauty) have not followed this path… yet. This is what Webel’s team found, and since then, they have been working on building a marketplace that would allow users to easily search, book, and enjoy almost any service in the comfort of their homes. And it’s definitely working: they have been growing 10x yearly for two consecutive years already, currently delivering over 100,000 services per year. Thanks to this impressive

-

Trind Trainings

We want to be supporting the future founders in building the next world-changing startups. As a part of this support, we are collaborating with accelerators, tech events, and other startup ecosystem players, sharing our experiences as investors and entrepreneurs. On this page, we have collected some of the presentations we have given, hoping that those might be useful for some of the founders. We are always happy to give a keynote or participate in a panel discussion or a fireside chat, so if you are looking for a presenter for your event, feel free to reach out to us. StartinLV

-

Startup Shareholders’ Agreement

Startup shareholders’ agreement is a key document in investing in a startup. Known also as the SHA, this document governs the roles and responsibilities of the parties from the investment to the exit of the company (unless, of course, replaced with a new one, e.g., in connection to a funding round). In this article, we look into key clauses that a typical shareholders agreement in a startup with external investors. Shareholders’ Agreement in a Startup A shareholders’ agreement is an agreement between the founders, investors, management shareholders, and the company. In the agreement, the parties set out their agreement on

-

Trind Invests in Re-Commerce Marketplace Mjuk

Brands struggle with overstock and returned products, as they take up expensive warehouse space and can’t be reintegrated into their own sales channels. Trind Ventures invests in Mjuk, whose end-to-end circular marketplace enables responsible brands to sell quality design products with attractive prices to consumers who are looking to enhance their circular economy lifestyles. Trind Ventures led the round where the Finnish re-commerce shop Mjuk successfully raised €2.5M in funding. The round was syndicated between Trind Ventures, Alliance VC, Superhero Capital, Lifeline Ventures, and angel investors. €0.5M of the funding was raised as a capital loan from Finnvera. The fresh

-

In Spotlight: eAgronom

In this blog post, we put the spotlight on eAgronom, a Trind Ventures GreenTech & AgriTech portfolio company empowering farmers to generate more revenue, improve soil quality, and reduce carbon emissions. About eAgronom eAgronom is a GreenTech company that provides digital tools for farmers to manage their operations more effectively, generate additional revenue streams, and improve their environmental sustainability. Their mission is to make farming more sustainable by empowering farmers with the right tools and data to make informed decisions. eAgronom started as a farm management software program that helped farmers to create a Planting Plan and crop protection schedule.