In this blog, we put the spotlight on RoyaltyRange, a leading provider of transfer pricing and IP valuation solutions.

About RoyaltyRange

RoyaltyRange is a leading provider of transfer pricing and IP valuation solutions. The company offers a comprehensive database of royalty rates, company financials, and other relevant data, as well as a variety of tools and resources to help businesses analyze their data and develop sound transfer pricing and IP valuation strategies. RoyaltyRange is well-positioned for continued growth in the years to come and is a valuable resource for businesses of all sizes.

RoyaltyRange was founded in 2017 by a team of experienced transfer pricing and IP valuation professionals led by Kestutis (Kris) Rudzika and Asta Rudzikiene. The company’s mission is to provide businesses with the data and tools to make informed decisions about their transfer pricing and IP valuation strategies.

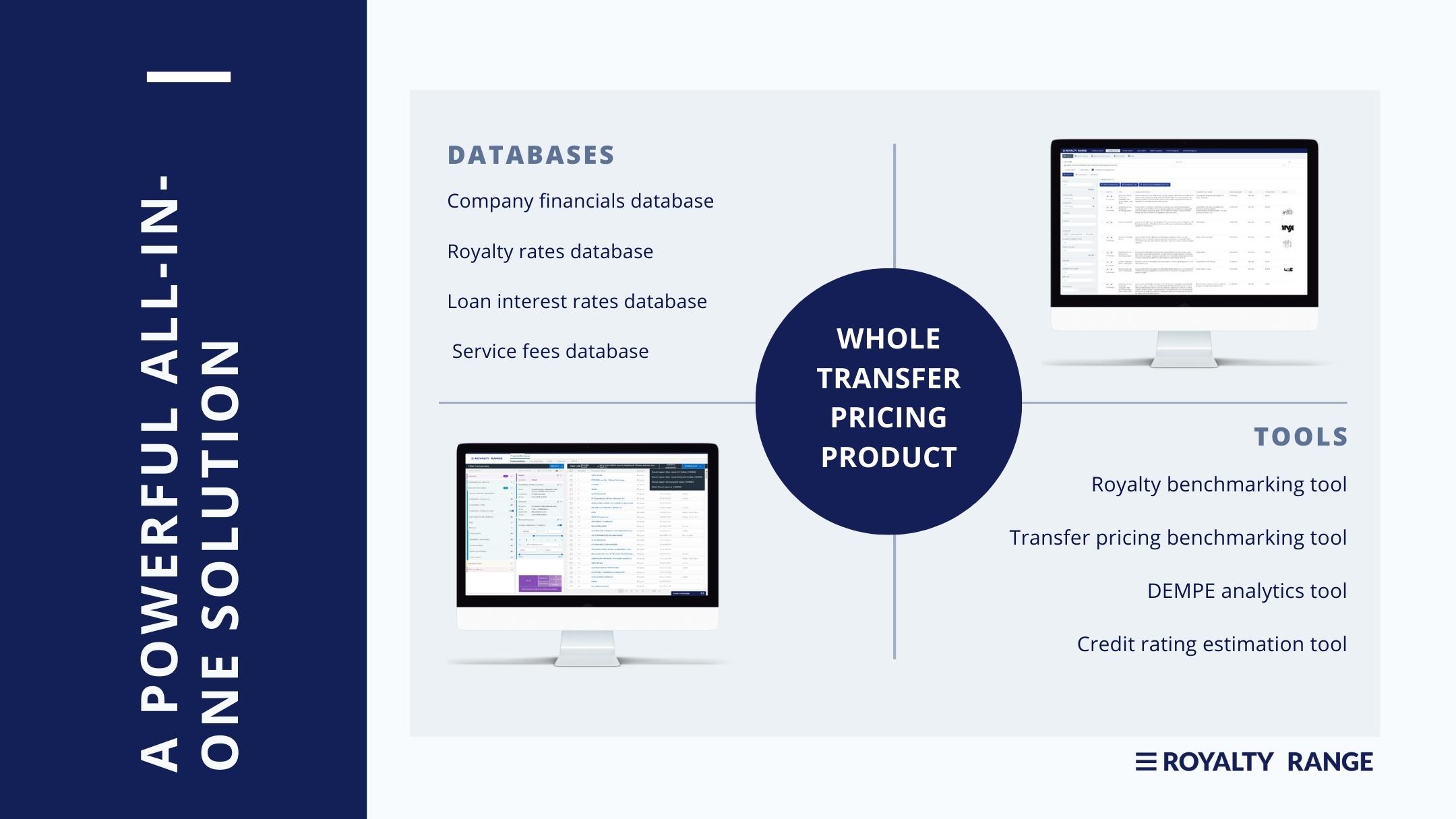

RoyaltyRange’s online platform provides users with a comprehensive database of company financials, ownership information, royalty rates, and other relevant data. The platform also includes tools and resources to help users analyze their data and develop sound transfer pricing and IP valuation strategies.

RoyaltyRange operates in the global transfer pricing and IP valuation market. The company’s customers include businesses of all sizes, from startups to Fortune 500 companies. RoyaltyRange’s customers include tax advisors, accountants, and other professionals advising businesses on transfer pricing and IP valuation matters.

RoyaltyRange Solutions

RoyaltyRange provides various products and services to help businesses with their transfer pricing and IP valuation needs. These include:

- Company financials database: RoyaltyRange’s company financials database provides users access to financial data for millions of companies worldwide. This data can be used to benchmark the performance of a company’s related parties and to develop sound transfer pricing and IP valuation strategies.

- Royalty rates database: RoyaltyRange’s royalty rates database is one of the largest and most comprehensive in the world. The database includes royalty rates for a wide range of industries and technologies and data on licensing agreements, comparable transactions, and other relevant factors.

- Transfer pricing tools: RoyaltyRange offers a variety of transfer pricing tools to help businesses with their transfer pricing compliance and planning needs. These tools include a transfer pricing benchmarking tool, a profit split calculator, and a transfer pricing documentation generator.

- IP valuation tools: RoyaltyRange also offers a variety of IP valuation tools to help businesses with their IP valuation needs. These tools include a patent valuation calculator, a trademark valuation calculator, and a brand valuation calculator.

RoyaltyRange Funding Round

In the summer of 2023, RoyaltyRange announced a four million euro round led by Presto Ventures. The funding will be used to accelerate RoyaltyRange’s growth and product development, especially with the company financial and ownership information solution.

RoyaltyRange and Trind

Trind invested in RoyaltyRange in 2021 and followed up in the 2023 round.

We liked the technology RoyaltyRange has developed and its capabilities to disrupt the current duopolistic market. Kris and the team have extensive experience in the field and can build a product that transforms how things are done. The progress since our first investment has been impressive, and we are excited about the future of RoyaltyRange.

Kimmo Irpola, Partner at Trind Ventures

The 2021 round was also joined by an angel investor with a background in tax and technology, Reima Linnanvirta, marking the beginning of cooperation between Reima and Trind, culminating in the partnership in 2022.

What’s Next?

In the future, RoyaltyRange plans to expand its product and service offering to include new transfer pricing and IP valuation tools and resources, as well as expand beyond these use cases. The company also plans to expand its geographic footprint into new markets.

RoyaltyRange is well-positioned for continued growth in the years to come. The company has a strong team of experienced professionals, a comprehensive product and service offering, and a large and growing customer base. RoyaltyRange is also investing heavily in new product development and market expansion.

Reima Linnanvirta, Partner at Trind Ventures and Chairman of the Board at RoyaltyRange