-

Let’s Talk About Founder Burnout

May is Mental Health Awareness Month – so in this blog post, Iryna Krepchuk talks about something that often hides behind pitch decks, investor updates, and product milestones: founder burnout. After eight years in the startup world, I’ve seen firsthand how tightly startup culture is tied to hustle culture. And to be fair, there’s truth to that – to survive (let alone win), you often do need to move fast and push hard. That famous quote, “building a startup feels like jumping off a cliff and building the plane on the way down,” sounds cool – but in reality, your body

-

Why VCs Ghost You at Startup Events — and What to Do About It

You’ve signed up for the event, built your profile, and sent out a stack of meeting requests. A few get accepted. Even fewer turn into real conversations. And some VCs don’t reply at all. It feels personal — but it’s usually not. In this blog post, Iryna Krepchuk discusses why VCs ghost you at startup events and what you can do about it. The Reality Behind the Ghosting Startup events are full of energy, optimism, and opportunity. But behind the scenes, investors are operating with very different goals and workflows. Here’s what most founders don’t realize: Not all VCs use

-

In Spotlight: Yaga – Rewriting the Rules of Pre-Loved Fashion

This time in our blog, we put the spotlight on Yaga, a pre-loved fashion marketplace taking over emerging markets. About Yaga Yaga is an innovative e-commerce platform that specializes in pre-loved fashion, aiming to make sustainable shopping accessible and convenient. Founded in 2017 in Tallinn, Estonia, the company has grown significantly, expanding its operations to emerging markets. Yaga’s platform allows users to buy and sell pre-loved clothing and accessories, promoting a circular economy and reducing the environmental impact of fast fashion. What Yaga Does Yaga operates as a person-to-person marketplace, enabling individuals to list and purchase second-hand items securely. The

-

Trind Invests in the Most Boring Business of 2025, SparkReceipt

SparkReceipt, a Tampere-based pre-accounting software provider, raised a funding round from Trind Ventures with support from the European Union under the InvestEU Fund and Business Finland to accelerate their international expansion. The Most Boring Business of 2025 How stupid is this? Paper, as an invention, was largely driven by the fact that keeping records on clay tablets was awful. Two thousand years later, not much has improved. There’s still no decent accounting software for the hundreds of millions of small business owners globally. Coming from Finland—a promised land of accounting, where structured e-invoices seamlessly transfer between systems—SparkReceipt has learned that,

-

Trind Invests in Bahn Express

Bahn Express, a Helsinki-based logistics startup, has successfully closed a €920k pre-seed funding round. The round was led by Trind together with Innovestor. In addition, Wave Ventures and notable angel investors, including Jiri Heinonen (co-founder of Swappie), Ekaterina Gianelli (ex-Inventure partner), and Tony Honkanen (expansion team Wolt) participated in the round. This funding will help the company advance its innovative solution for faster, more cost-effective cross-border used car deliveries and help scale operations to further European markets. Founded in early 2024, Bahn Express optimizes cross-border used car transportation by combining technology and a driver-based delivery network. The startup’s unique approach

-

Evaluating Startup Teams

All investors say they invest in exceptional founders. But how does an investor tell if a team is exceptional? In this blog post, Reima Linnanvirta shares his thoughts on the subject. Quantifiable vs. a Gut Feeling Often, I hear the argument, “I know a great team when I see it.” While I agree with the statement to some extent, it offers very little guidance for the aspiring founder trying to build their team or the VC associate trying to develop their skills. Thus, I try first to focus on quantifiable items, at least to some extent. Experience The relevant experience

-

Trind Invests In Evogenom

Trind leads the investment round in Evogenom, alongside several angel investors. Evogenom provides genetic insights and science-based advice for individuals interested in enhancing their well-being. This information is accessible through Evogenom’s mobile application, available after clients complete an at-home genetic test and return it to the company. Evogenom stands out as it has developed its own genotyping chip and software for comprehensive analysis, focusing on the genetics of traits. This funding strengthens our sales initiatives, allowing us to grow our business and solidify our market position. It also enables us to refine our products and supports our international expansion efforts.

-

In Spotlight: Mjuk – Breathing New Life into Furniture in Finland and Beyond

In this blog post, we will take a deeper look into Mjuk, our portfolio company tackling furniture waste with recommerce. About Mjuk The furniture industry is a major contributor to global waste. Between discarded furniture from homes and unsold stock collecting dust in warehouses, the environmental impact is significant. Thankfully, innovative companies like Mjuk are emerging to tackle this problem head-on. Mjuk is a Finnish startup that is revolutionizing the way we buy and sell furniture. They have created a user-friendly online marketplace where people can buy and sell high-quality second-hand furniture, as well as overstock and retailer returns from

-

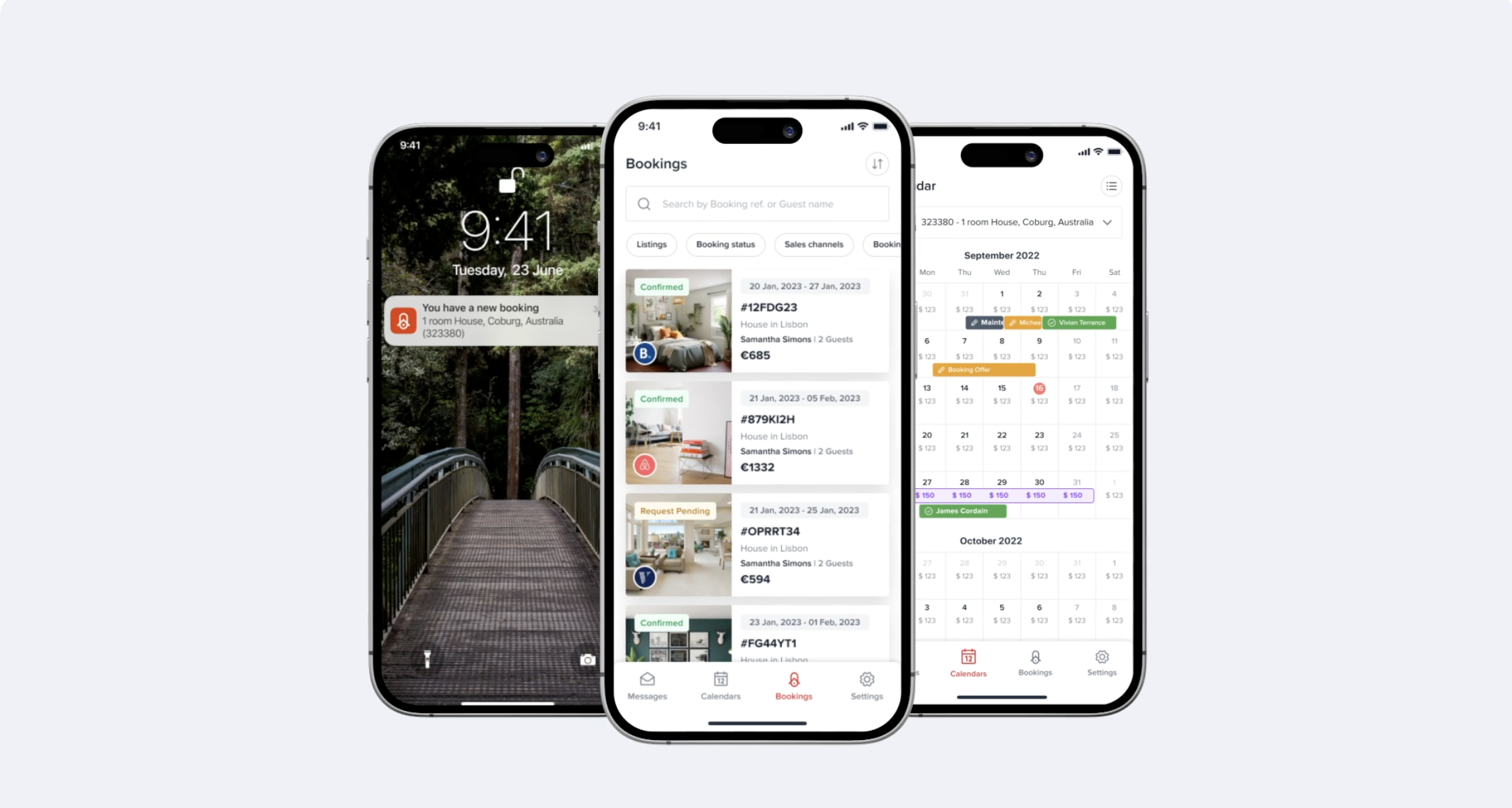

Your.Rentals raises €1.7m to expand market reach

Your.Rentals, a leading all-in-one short-term rental management platform, raises €1.7m from existing shareholders to expand its market reach. In a tough market for raising growth capital, we’re extremely happy to have the ongoing support of our shareholders to continue growing the business. Chairman and co-founder Klavs Pedersen Since its last capital raise in 2023, the company has accelerated its investments into R&D to broaden the capabilities of its “all-in-one” platform, releasing the following improvements to its customers: Dynamic pricing from PriceLabs and Airdna – letting customers automate their pricing and increase revenue by 20 – 30% on average. Unified inbox

-

Jobilla Raised Six Million Euros

Jobilla, a company specializing in digital recruitment technology, raised six million euros Our portfolio company, Jobilla, a Helsinki, Finland-based company specializing in digital recruitment technology, raised six million euros in additional funding. We and Juuri Partners led the round. It was supported by Business Finland and business angels, including Matti Vikkula, who will join Jobilla as the Chair of the Board. The company intends to use the funds to improve the AI-driven platform and increase its market position in Europe. Led by CEO Henri Nordström, Jobilla is a candidate-focused recruitment tool that makes it easy for companies to recruit in