-

Trind Trainings

We want to be supporting the future founders in building the next world-changing startups. As a part of this support, we are collaborating with accelerators, tech events, and other startup ecosystem players, sharing our experiences as investors and entrepreneurs. On this page, we have collected some of the presentations we have given, hoping that those might be useful for some of the founders. We are always happy to give a keynote or participate in a panel discussion or a fireside chat, so if you are looking for a presenter for your event, feel free to reach out to us. Webinar

-

Startup Shareholders’ Agreement

Startup shareholders’ agreement is a key document in investing in a startup. Known also as the SHA, this document governs the roles and responsibilities of the parties from the investment to the exit of the company (unless, of course, replaced with a new one, e.g., in connection to a funding round). In this article, we look into key clauses that a typical shareholders agreement in a startup with external investors. Shareholders’ Agreement in a Startup A shareholders’ agreement is an agreement between the founders, investors, management shareholders, and the company. In the agreement, the parties set out their agreement on

-

Trind Invests in Re-Commerce Marketplace Mjuk

Brands struggle with overstock and returned products, as they take up expensive warehouse space and can’t be reintegrated into their own sales channels. Trind Ventures invests in Mjuk, whose end-to-end circular marketplace enables responsible brands to sell quality design products with attractive prices to consumers who are looking to enhance their circular economy lifestyles. Trind Ventures led the round where the Finnish re-commerce shop Mjuk successfully raised €2.5M in funding. The round was syndicated between Trind Ventures, Alliance VC, Superhero Capital, Lifeline Ventures, and angel investors. €0.5M of the funding was raised as a capital loan from Finnvera. The fresh

-

In Spotlight: eAgronom

In this blog post, we put the spotlight on eAgronom, a Trind Ventures GreenTech & AgriTech portfolio company empowering farmers to generate more revenue, improve soil quality, and reduce carbon emissions. About eAgronom eAgronom is a GreenTech company that provides digital tools for farmers to manage their operations more effectively, generate additional revenue streams, and improve their environmental sustainability. Their mission is to make farming more sustainable by empowering farmers with the right tools and data to make informed decisions. eAgronom started as a farm management software program that helped farmers to create a Planting Plan and crop protection schedule.

-

What is a Term Sheet and What Should One Know About It?

Every funding round will be concluded with a set of agreements collectively called investment documents. These are the term sheet, the shareholders’ agreement, and the investment or subscription agreement. In this blog post, we look at some key elements of a typical term sheet. Later, we will dive deeper into the term sheet and address the shareholders’ agreement and investment agreement in upcoming posts. What is a Term Sheet? A term sheet is typically the first document to be signed between the investors and the startup. It is intended to lock down key terms of the investment and related conditions.

-

In Spotlight: RangeForce – Revolutionizing Cybersecurity Training

In today’s digital landscape, organizations face ever-increasing cyber threats. Cybersecurity professionals require up-to-date skills and hands-on training to combat these threats. In this blog post, we look deeper into how our portfolio company RangeForce revolutionizes cybersecurity training. Cybersecurity Simulations and Skills Analysis Platform RangeForce offers an integrated cybersecurity simulation and skills analysis platform that aims to bridge the skills gap in the industry and empower defenders against cyber threats. They do this by addressing the skills gap, cybersecurity tutorials and resources, interactive and gamified learning, and assessing the skills and progress. RangeForce understands the pressing need to address the skills

-

The Power of Collaboration: How Angel Investors and Venture Capitalists Can Cooperate

At Trind, all our partners are angel investors who became venture capitalists. Thus, it is unsurprising that we see tremendous value in cooperation with business angels. In fact, our investment thesis relies heavily on the collaboration between us and angel investors. In this blog post, we dive deeper into the different cooperation opportunities that angel investors and venture capitalists have, resulting in mutual benefits and increased startup success. Referrals, Co-Investments, and Follow-On Funding Angel investors, renowned for their vast networks, possess a unique ability to identify promising startups at their early stages. By partnering with venture capitalists, these angel investors

-

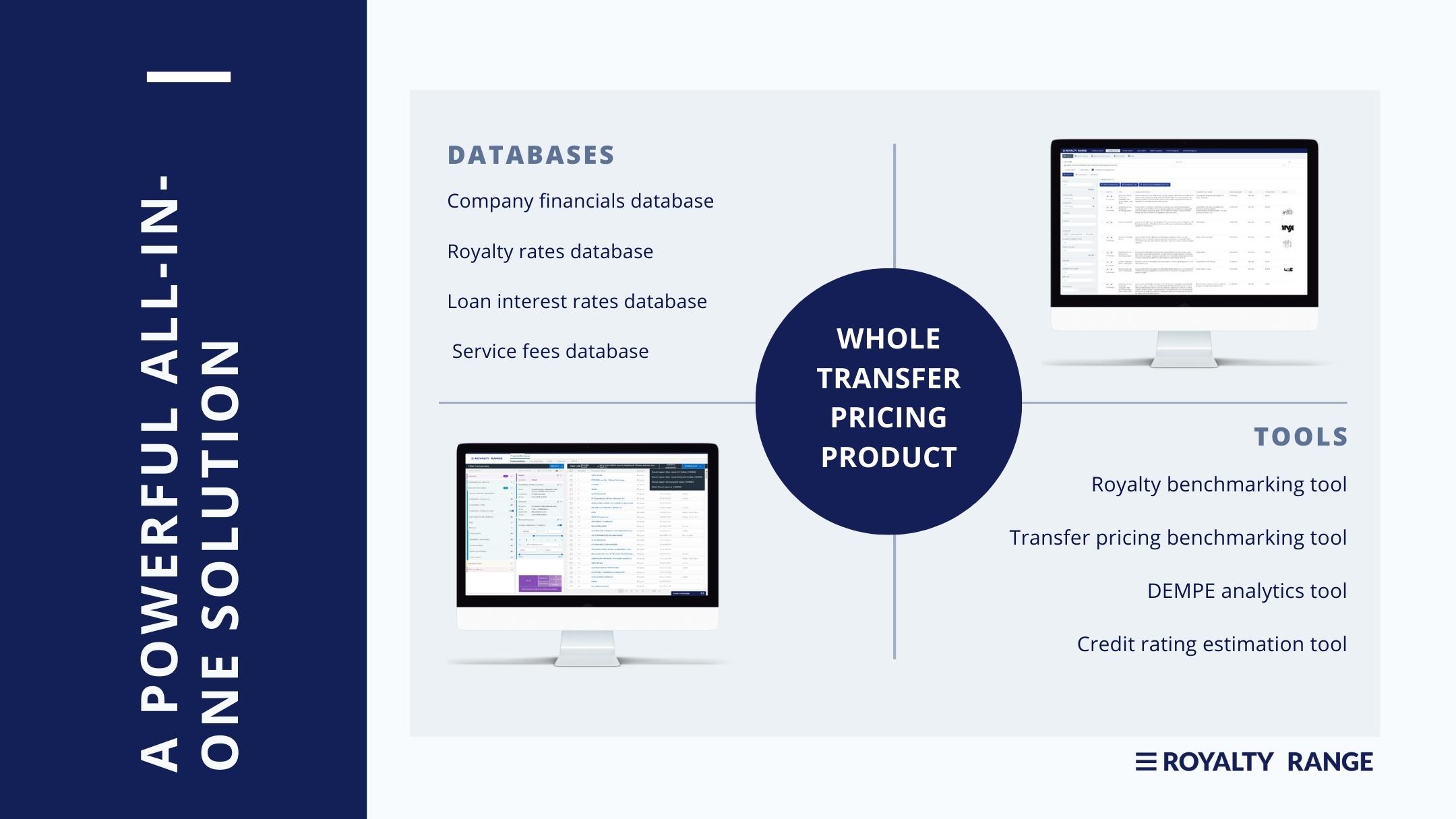

Business information provider RoyaltyRange raised €4M+ from current and new investors

RoyaltyRange, a leading provider of professional databases used in International Tax and IP Valuations, attracted more than €4M in a joint investment from a diverse group of investors. The round was led by Prague-based VC fund Presto Ventures and was joined by experienced venture capital firms Trind Ventures (€1M) and ZGI Capital (€1M) and a number of angel investors from the Baltic region and Finland. The funding will be used to further grow and deepen the breadth and quality of data used in the company’s product portfolio. RoyaltyRange focuses on the market for databases – a fast-growing area within International Tax

-

In Spotlight: Neural DSP

About Neural DSP Neural DSP produces state-of-the-art amplifiers and plugging powered by artificial intelligence and neural networks. Their mission is to empower musicians by democratizing access to world-class sound. Neural DSP was founded in Helsinki, Finland 2017 by Chilean musicians Douglas Castro and Francisco Cresp. Neural DSP was the second company for Douglas, having founded Darkglass Electronics earlier in his career. With both companies, his dream has been the same: To create products that would help musicians take their sound to the next level. The Product Neural DSP aims to develop technology to advance the stage of the art in

-

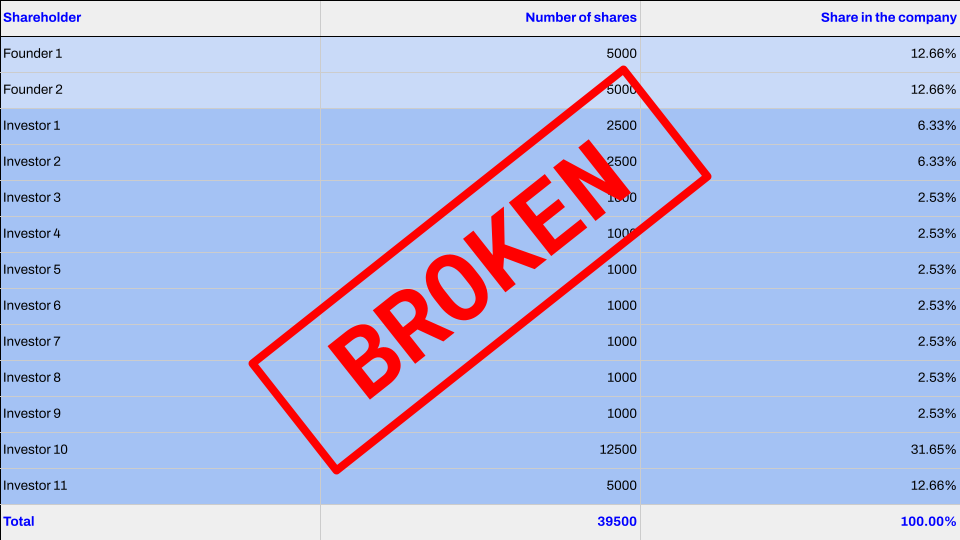

How to Fix a Broken Cap Table?

Our previous article was about the importance of an investable cap table. After that article, we got approached by founders asking how to fix a broken cap table. While the best way to avoid this situation is to not give out too much equity in the first place, other tools can be used to solve the problem. In this article, we take a look at some of these tools. Avoiding Overdiluted Cap Table To keep the cap table investable, the best solution is to avoid overdiluting it. While dilution is inevitable in equity investments, some ways can be used to